THIRD-PARTY CLAIMS ADMINISTRATION

A Dramatically Different Approach to Managing Claims

by Increasing Efficiency and Minimizing Costs

The Better Way to TPA

Third-Party Claims Administration, Focused on Your Needs

ONLY 75 CLAIMS PER ADJUSTER

OccuSure's unique, hands-on claims model increases efficiency and minimizes costs per claim.

Our claims model is designed to provide employers with a partner to ensure claims are managed proactively when accidents occur. Unlike the industry, each adjuster is a single point of contact for our customers and handles a total of 75 claims from start to finish. This allows for responsive communication, better investigation, faster return to work, less attorney involvement, and maximum cost containment.

OUR EXPERTISE

Large Deductible

Self-Insured

Guaranteed Cost

Run Off Claims

Captive Management

Workers Compensation

Occupational Accident

TX Non-Subscriber

General Liability

Auto Liability

COMBINING HANDS-ON CUSTOMER SERVICE WITH THE LATEST TECHNOLOGY

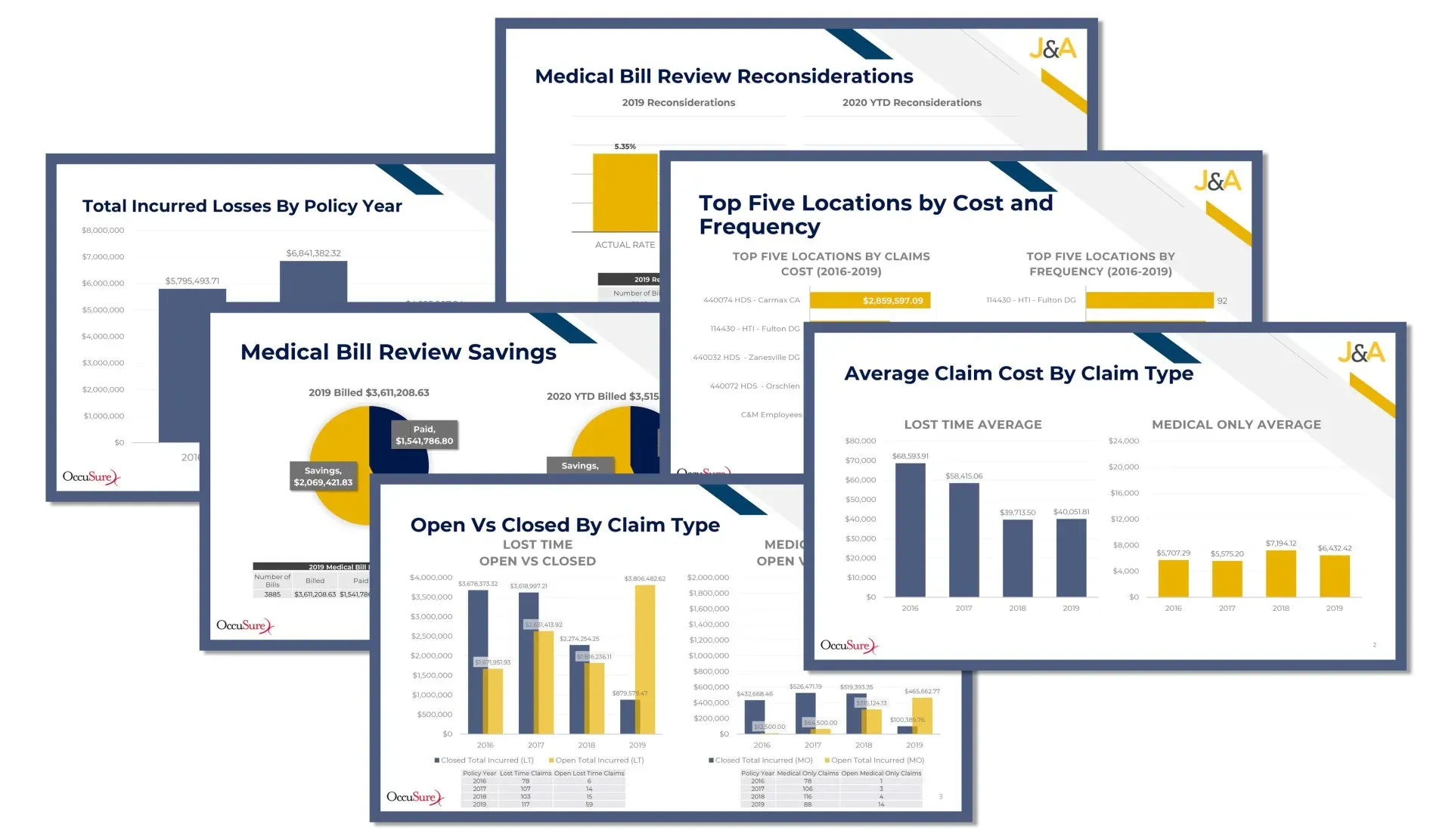

OccuSure’s web-based RMIS system allows us to customize to your individual needs. We recognized that each customer has unique risk management concerns and we provide the data analytics to provide solutions and meaningful analysis to address what is important to YOU. The system is user friendly and access levels are customizable to your unique needs. All data is provided in real time. Reports can be delivered to your team on a scheduled basis or on demand as needed. Our team provides regular claim reviews to our accounts to ensure their program is being proactively managed. Periodic trend analysis allows for early identification of loss drivers.

SAVE TIME

AVERAGE CLAIM DURATION

REDUCED BY 50%

Our timely and efficient claims model focuses on proactive management of every aspect of the claim.

SAVE MONEY

AVERAGE CLAIM COST

REDUCED BY 30%

Our adjusters' low claim count allows the time to ensure every dollar is wisely spent, thus decreasing costs.

INCREASE PRODUCTIVITY

AVERAGE LOST TIME CLAIMS

REDUCED BY 38%

Our focus on aggressively returning employees to work, decreases fraud and increases productivity.